The Short Term and Long Term Future of Bitcoin

- May 14, 2024

- Bradley Taylor

You might be amazed at how many people I talk to who think Bitcoin (and other cryptocurrencies) are some sort of scam or Ponzi scheme. There are a multitude of reasons they think this.

Usually when the currency makes the mainstream news it’s a story about FTX or some other exchange which folded, taking all their customers’ money with them. It’s important to remember that mainstream news is funded by large companies and banks and they don’t really like BTC. And neither do governments. This is because they cannot control it , manipulate it, or inflate it.

Another reason why people think it’s an illegitimate currency is simply due to their lack of understanding and/or using it. It’s no different than if I gave you 100,000 Rubles or Lira and told you to have fun with it. You would scramble trying to figure out what to do with it, how to exchange it for something you can use at your local markets.

Distrust is another reason people don’t believe Bitcoin is real currency. They don’t understand “who owns it” or “who’s in charge”, which if you understand cryptocurrency, you know that the answer is “nobody and everybody”.

Personal Experience

I’ve followed crytpocurrency for over ten years and have literally seen someone turn $10,000 into millions of dollars (not me unfortunately). I have seen exchanges come and go. I can tell you for every negative headline and person with a bad experience there are five positive stories that don’t make the news and 5 people with good experiences.

It’s a good long term investment and payment method. As a payment method, the fees are usually very low compared to credit card fees associated with using a charge card. You can buy something for $1,000 and pay just $1.50 for the transaction. This is not always the case however. Sometimes fees can shoot up into the $20-$30 range, which is something BTC will need to get under control.

Price Prognosis

There will only ever exist 21 million bitcoins. It’s not like the current fiat system where they print money out of thin air. This finite amount and scarcity makes it attractive as an investment. We have already seen the price of one Bitcoin grow from about $200 ten years ago to as high as about $75,000 earlier this year. It is currently resting around $60K as of me writing this article.

BTC can be bought, sold and used on a factionary basis. You don’t have to send or buy a whole BTC. In fact, 99% of all BTC transactions are made with fractions of the currency called “Satoshis“. They are scalable down to 0.00000001 BTC, which equals a fraction of a penny. Currently, .01 BTC equals about $617 USD. You can use this converting tool to learn more.

Projections

Vegas has an over/under for BTC at the last second of December 31st, 2024 at $68,000. You can actually bet over or under this number. My belief is that this is a low number and BTC should be well over that mark at year’s end.

More and more companies are accepting its use and that will drive up demand for what will always be a limited supply (you can see a list of companies who accept BTC here). Not only that, but large financial institutions and trading firms have gotten into the cryptocurrency game. Here is a short list of some of those companies:

1. Voyager

2. Charles Schwab

3. Tesla

4. Blockrock

5. Microstrategy

Price Projection After “Halving”

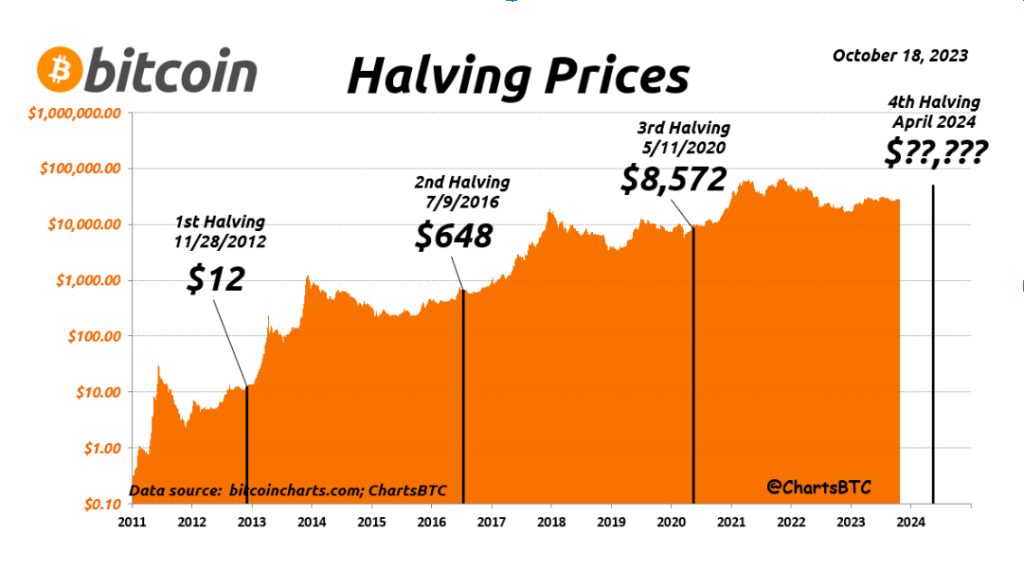

Those people who participate in running the BTC system by using their electricity and mining servers receive BTC as a reward for their efforts. Every four years the reward is reduced by half. This design was built-in because the architect of BTC understood that the value of BTC would rise and there should be some measure to control the rewards system. The “halving” also correlates directly to the amount of BTC left to be mined. As the unmined BTC gets smaller, so do the rewards. It only makes sense. The architect also understood that technology would constantly be improving and it would allow miners to improve their mining speed and efficiency. The having is a way to keep them in check.

Traditionally, prices have increased after these halving events as you can see from the chart below:

The most recent halving just took place last month. This is just another piece of evidence which causes us to conclude that the world’s leading cryptocurrency will to continue to trend upward with no limit in sight.

Financial Model of Price Prediction

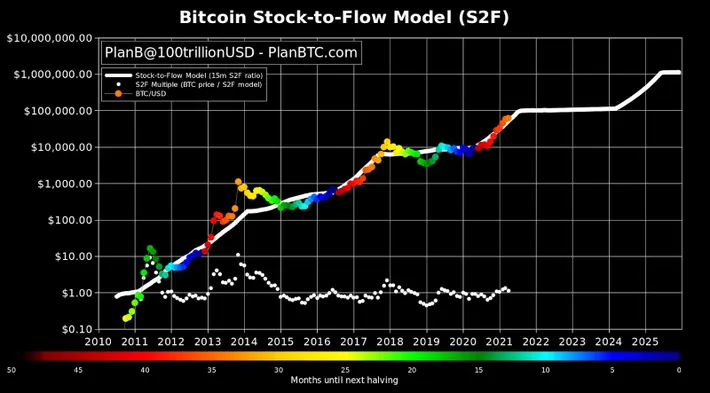

A few years ago, Forbes posted a chart showing the likely path that BTC would take. The chart shows historical performance and likely trajectory.

According to the chart, BTC should be sitting at about $100K right now. At $60K BTC is technically undervalued. The chart also shows that BTC could hit $1M in one year from now.

Do we think $1M a year from now is likely? No. But it is possible. Global financial instability and high interest rates have the general public in a “bearish” state of mind. It wouldn’t be a surprise to see a massive increase in BTC price once inflation is stabilized and interest rates are lowered.

I wouldn’t be astonished if one BTC were worth $250,000 by decades end. I think a half million dollars for one BTC would be pleasantly surprising and $1M+ would be a real shock.

Our projections are light when you compare them those made by former Twitter CEO Jack Dorsey. Recently, he came out and said $1M+ is a very realistic mark by 2030. “I don’t know,” said Dorsey, ” Over… at least a million. I do think it hits that number and goes beyond.” – source Coindesk

Intriguing Video

I ran across a video recently where a guy making the video states a pretty good case to be optimistic on BTC reaching the higher end projections. He discusses the amount of capital that is basically in limbo and looking for a home.

Conclusion

BTC as a tool for everyday transactions, replacing methods like Mastercard or Visa, is not what it is currently configured for. The system simply isn’t capable of handling those sort of numbers. Perhaps one day it will be but until then, using BTC as a store-of-value and a way to send lump sums to people or companies is what it is best for at this time. But it’s most attractive feature is it’s use as an investment vehicle. There is no doubt that it will increase in value as time moves forward.